Accounting reconcilliation project for Uber

2023

While at NECTO Systems, I had the opportunity to work with Uber facing challenges in their accounting reconciliation for tax purposes. The goal was to reconstruct and reconcile financial reports from their databases, aiming to create an automated pipeline to facilitate this process. As a data analyst, I played a key role in addressing these challenges and delivering effective solutions.

Context

Uber was granted authorization by the São Paulo city hall starting in 2019 to operate under a special single invoice regime for the collection of fees charged per kilometer driven in the capital. However, it is still necessary for the company to maintain a complete record of which trips and their respective values make up this invoice, for the public oversight agency.

Challenge

The client struggled with reconciling their financial information, with many manual interventions during the process, which compromised their efficiency to meet tax obligations and keep accounting practices aligned with global standards. The challenge was to develop an automated process for data retrieval and reconciliation, using data engineering techniques.

Solution

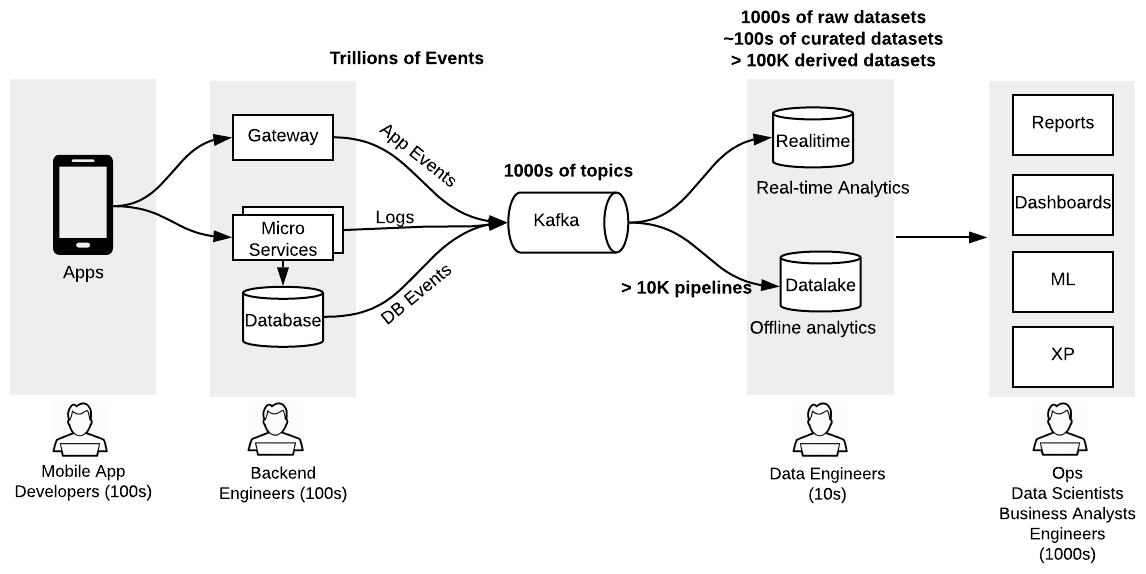

As a data analyst, I developed a customized solution for the client, employing skills and tools such as SQL, Python, Pandas, Hive, and Presto. The approach involved analyzing the client’s data, creating an automated pipeline for data retrieval and reconciliation.

Results

With the implementation of the solution proposed, the client successfully reconciled financial reports for their business lines, ensuring the required compliance and adopting accounting practices aligned with global standards. This change provided greater reliability and efficiency in accounting and tax processes, generating significant benefits for the client.